Common Blunders to Prevent for First-Time Home Purchasers on Their Journey

As a new home buyer, it's very easy to overlook crucial elements of the procedure. Skipping crucial actions like mortgage pre-approval or home assessments can lead to expensive shocks.

Failing to Develop a Realistic Budget

Creating a solid budget plan is vital for novice home buyers. Include home loan repayments, property taxes, insurance coverage, and maintenance expenses in your estimations.

You'll wish to set a sensible rate array based on these figures. Stay clear of the lure to extend your budget for a desire home; it can bring about economic stress later. In addition, be versatile with your wants and needs; prioritize essentials over high-ends. A well-planned budget will not only guide your home search however also provide assurance as you browse this substantial financial investment. Stick to your budget plan, and you'll make smarter choices throughout the buying procedure.

Disregarding Added Expenses Past the Purchase Cost

Residential Or Commercial Property Tax Obligations and Insurance Policy

While you have actually likely allocated for the purchase cost of your brand-new home, it's vital not to ignore the recurring prices of building tax obligations and insurance coverage. Residential or commercial property tax obligations differ based on location and home worth, so research study your location's rates to avoid shocks. By recognizing these recurring costs, you'll be better prepared to manage your funds and appreciate your new home without unforeseen financial stress and anxiety.

Repair And Maintenance Expenses

Several first-time home purchasers undervalue the value of budgeting for upkeep and fixing costs, which can promptly include up after relocating in. It's not simply the acquisition rate that matters; there are recurring prices you need to take right into account. Houses require regular upkeep, from lawn treatment to plumbing repair services. You could deal with unforeseen concerns like a dripping roofing or damaged appliances, which can hit your wallet hard. Experts recommend alloting 1% to 3% of your home's worth every year for upkeep. By doing this, you're prepared for both regular and surprise costs. OC Home Buyers. Do not let these prices capture you off guard-- factor them right into your budget to assure a smoother change into homeownership.

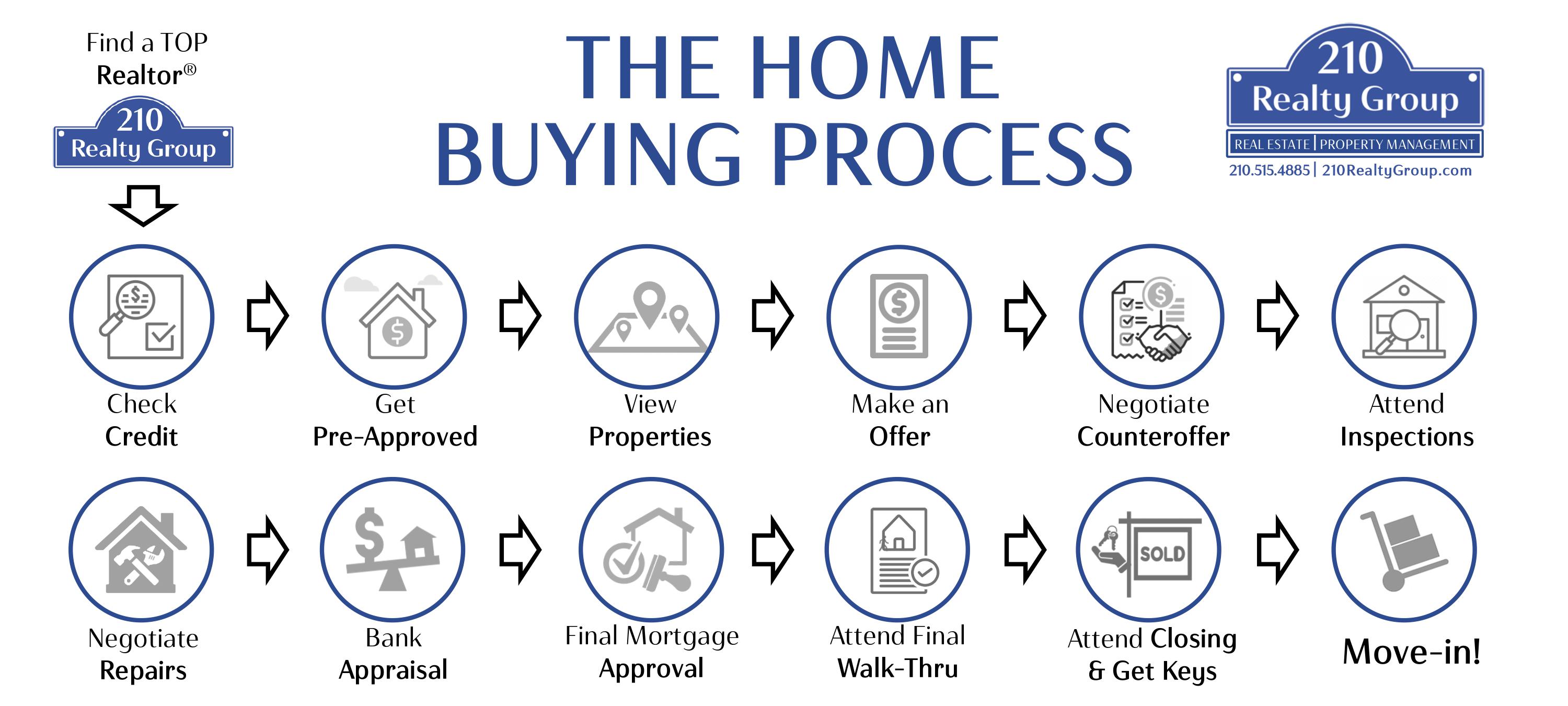

Skipping the Home Loan Pre-Approval Process

Frequently, first-time home buyers forget the significance of getting pre-approved for a mortgage before beginning their home search. This step isn't simply a rule; it's necessary for specifying your budget plan and streamlining your search. Without pre-approval, you risk falling in love with a home you can not manage, wasting time and power.

Pre-approval gives you a clear concept of just how much you can borrow, making you an extra eye-catching buyer. Vendors commonly like deals from pre-approved buyers because it shows you're major and financially all set.

Additionally, avoiding this action can bring about delays in the future. When you locate a home you enjoy, you'll wish to act rapidly, and having your funds sorted out in development can make all the distinction. Don't ignore the power of pre-approval; it establishes a strong structure for your home-buying trip.

Forgeting the Value of a Home Assessment

When you're purchasing a home, missing the examination can be an expensive error. A complete examination exposes possible issues and aids you recognize the home's true condition. Don't forget this vital action; it might save you from unanticipated fixings down the line.

Comprehending Examination Conveniences

While it may be alluring to skip a home evaluation to save time or money, doing so can bring about costly surprises down the roadway. A thorough inspection assists you discover potential concerns with the residential property that you could not see during a walkthrough. You'll gain insight into the home's condition, including the roofing system, pipes, and electrical systems. This expertise empowers you to negotiate repair services or adjust your offer based on the findings. Additionally, an examination can supply satisfaction, guaranteeing you're making a sound investment. Keep in mind, a tiny upfront price for an inspection can conserve you from substantial expenditures in the future. It's a vital step in your home-buying journey that you should not forget.

Common Inspection Oversights

Lots of newbie home customers site web take too lightly the significance of a home assessment, assuming it's either unneeded or too costly. You may miss surprise concerns like mold, pipes problems, or electric dangers that can set you back thousands to repair later on. A tiny upfront price can save you from major headaches down the roadway.

Not Investigating the Community

Speak with prospective neighbors to obtain a feel for the community. Are they pleasant? Do they look after their homes? This understanding can help you understand what living there could be like. Likewise, do not neglect to inspect crime rates and future development strategies. These elements can considerably influence your home's value and your high quality of life. By spending time in community research study, you'll make an extra educated decision, guaranteeing your brand-new home is genuinely a location you'll love for many years to find.

Hurrying Into a Decision

Rushing into a decision can lead to pricey errors when purchasing your first home. You might really feel forced by enjoyment or an open market, but taking your time is essential. Avoiding essential actions like detailed examinations or appropriate research study can result in remorse and economic stress down read this the line.

Before making a deal, think about all the factors-- area, budget plan, and future needs. It's important to review buildings very carefully and not just opt for the initial one that catches your eye. Review your alternatives with a trusted realty agent that can offer beneficial understandings.

Ignoring to Understand the Home Purchasing Refine

Avoiding action in the decision-making procedure typically results in forgeting essential facets of home buying. If you don't completely understand the home getting process, you run the risk of making pricey mistakes. Begin by acquainting on your own with crucial terms like pre-approval, backups, and closing expenses. Each action, from looking for a home to making a deal, plays an important duty in your journey.

Additionally, recognize your economic limitations and how home mortgage prices work. A clear understanding of these concepts assists you make notified decisions. By putting in the time to educate on your own on the home purchasing procedure, you'll feel more certain and prepared, inevitably resulting in a smoother purchase.

Frequently Asked Concerns

Exactly How Can I Boost My Credit Scores Rating Before Getting a Home?

To boost your credit report before acquiring a home, pay down existing financial debts, make settlements in a timely manner, limit new credit questions, and examine your credit score report for errors. These actions can markedly improve top article your rating.

What Kinds of Home Loans Are Available for First-Time Buyers?

As a newbie customer, you'll find several home loan kinds available, like fixed-rate, adjustable-rate, FHA, and VA finances. Each option has distinct benefits, so examine your economic scenario to choose the very best suitable for you.

Should I Deal with an Actual Estate Representative or Do It Myself?

You need to definitely consider working with a realty agent. They've got the experience and resources to navigate the market, discuss far better bargains, and conserve you time, making the home-buying procedure smoother and more efficient.

For how long Does the Home Purchasing Process Normally Take?

The home acquiring procedure commonly takes about 30 to 60 days as soon as you have actually made a deal. Nevertheless, aspects like financing and assessments can prolong this timeline, so it's finest to remain prepared and flexible.

What Are Closing Expenses, and Exactly How Much Should I Expect to Pay?

Closing costs are fees due at the home purchase's end, consisting of loan source, evaluation, and title insurance coverage. You ought to anticipate to pay about 2% to 5% of the home's price in shutting expenses.

Comments on “OC Home Buyers: How to Time the Market for the Best Deal”